What is a Supply Chain and what is Supply Chain Financing?

What is a Supply Chain and what is Supply Chain Financing?

What is a Supply Chain?

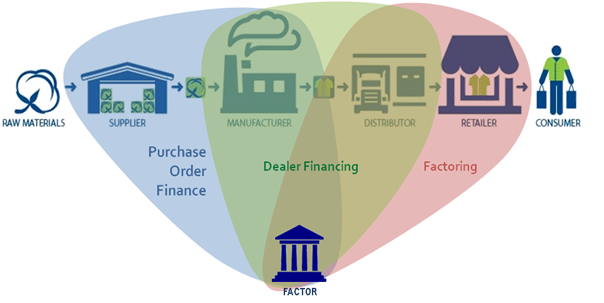

A supply chain consists of various stages between raw materials and consumer. A Supplier would deliver raw materials to a Manufacturer who would produce goods, which would be sold to a Distributor. The Distributor (Dealer) would sell the goods to Retailers who would sell them to end customers (Consumers).

There could be more complex scenarios where goods manufactured become materials to another product, which could be used to manufacture another product. For example, there could be manufacturers of Silicon chips that would sell the product to companies that would produce transistors which are used by TV manufacturers to produce TVs.

What is Supply Chain Financing?

Regardless of the complexity of the Supply Chain, a common attribute of a supply chain is lack of funding, or in other words, lack of working capital. This global attribute is addressed by financiers by way of various Supply Chain Financing Solutions in different forms, with different attributes to suit where it fits in the Supply Chain.

- Work Order Financing provides financing for a raw material supplier until he is paid by the manufacturer.

- Dealer Financing (Distributor Financing) caters to the financial requirement of Dealer (Distributors) as the Dealer has to settle the manufacturer (or an exporter) before he recovers money from the retail chain.

- Factoring applies to retailers who sell to their clients (typically business entities) on credit basis as the retailer has to manage his financials until he recovers at the end of the credit period.